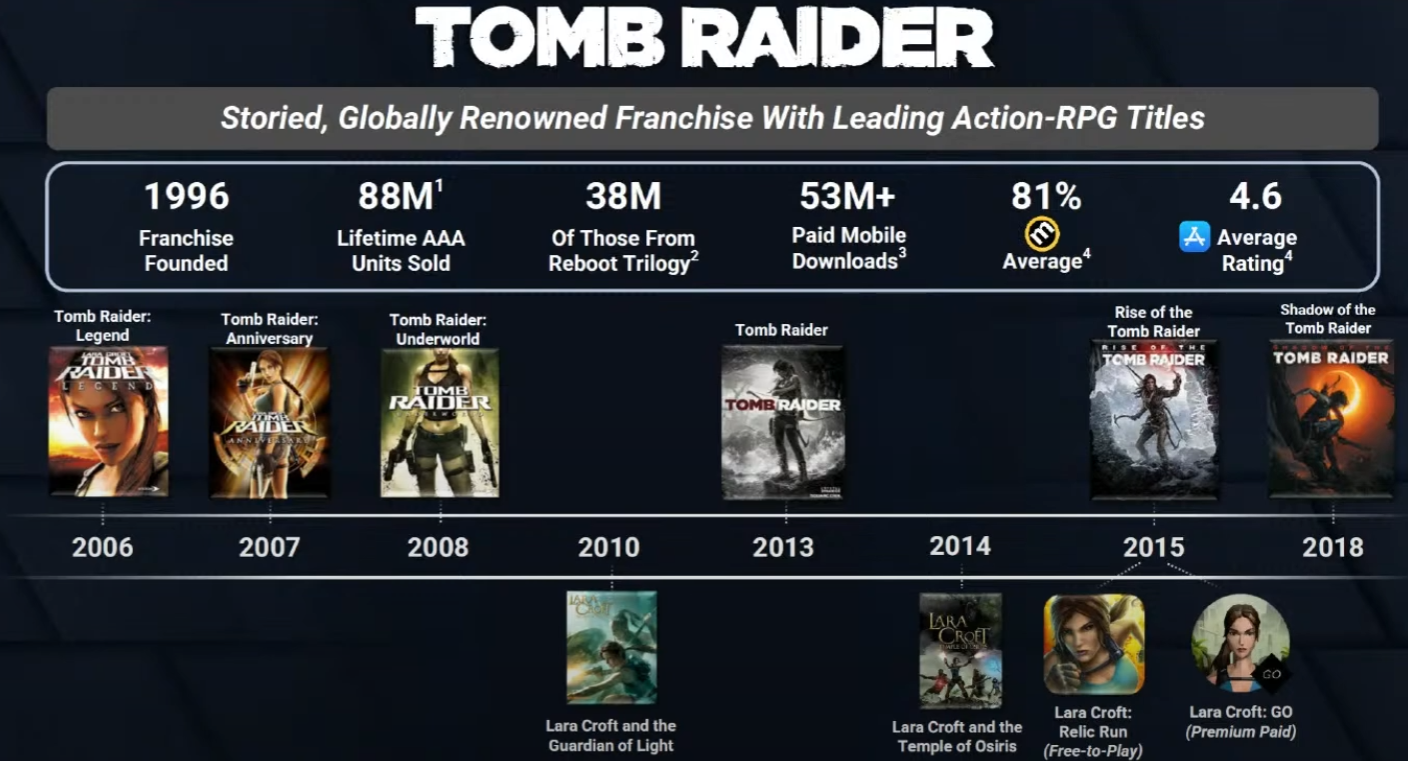

Though Square Enix will retain some of its Western IP – namely Just Cause, Life Is Strange, and Outriders – it’s clear the publisher was eager to get rid of a lot of its most notable brands. And it makes sense; Square Enix has been publicly disparaging of its Western studios in recent years. It almost felt like a disappointed parent moaning about its kids to the other parents at the school gates. Whether it was Tomb Raider, Deus Ex, Marvel’s Avengers, or Guardians of the Galaxy, Square Enix would (loudly) put out releases calling them ‘sales disappointments’ or talking about how unimpressed it is with the performance of the live-service aspect of the games. Even back in 2013, the Tomb Raider reboot sold 3.4 million units in just four weeks – and that was still a failure in the eyes of Square Enix. Eesh. But, following Embracer Group’s agreement to purchase the three big studios (Eidos Montreal, Square Enix Montreal, and Crystal Dynamics) from Square Enix, alongside a shedload of IP, the investment company shared a timeline of the Tomb Raider franchise. Complete with some sales info we’ve not seen presented in this way before. Per the timeline, Tomb Raider has sold 88 million units since the first game launched way back 1996. A significant chunk of that number – some 38 million sales – is attributed to the Reboot Trilogy alone, which kicked off with Tomb Raider (2013) and went on to spawn both Rise of the Tomb Raider, and Shadow of the Tomb Raider. TL;DR? It’s a popular series, with a lot of potential. So why was Square Enix so eager to offload it – and for so cheap? Allow friend of VG247 and games business veteran, Chris Dring, to put it into easy-to-understand terms. Square Enix, it would appear, is eager to free itself from a suite of expensive studios – and get a nice, fat cash injection at the same time. It’s been clear for some time that the Japanese publisher is at a bit of a loss with what to do with these studios, so making Embracer pay a nice big lump sum to acquire them is a kind-of win for all sides, right? Axios’ Stephen Totilo weighs in on matters, too. Noting that in 2021, Embracer paid more than double what it paid to Square Enix for 50+ IP and three studios… for a mobile gaming company called Easybrain. Given that Square Enix notes its studios generated roughly $200 million in revenue last year (but less than $8 million in operating income), it’s easy to see why the publisher wanted to offload these studios to Embracer – a company that’s clearly got enough cash knocking around to invest in these companies in a way Square Enix seems reticent to. The long and short of it? Square Enix did a deal to Embracer for $300 million – which is small in comparison to megaton deals like Sony’s $3.6 billion takeover of Bungie. Especially when you consider Embracer is also picking up the rights to the Tomb Raider films (three exist already, and we’ll see about a fourth), Lara’s status as a cultural icon, and the potential of a Deus Ex movie to come. In reality, that’s a lot of cash, but Embracer has really hit a goldmine here thanks to Square Enix looking for a quick-fire cash injection. And if everything goes to plan for the firm, maybe we’ll even see some other legacy game series appear on modern consoles, too.